Arizona one of a dozen states to participate in IRS pilot program

ASU accountancy expert shares what filers can expect

Arizona is one of a dozen states unveiling a pilot program this year that allows taxpayers to electronically file their federal tax return directly with the IRS for free. Photo courtesy iStock/Getty Images

This year, the Internal Revenue Service announced that Arizonans could take advantage of a pilot program that allows taxpayers to electronically file their federal tax return directly with the IRS for free.

Called Direct File, the new program is also user-friendly and much more secure than in years past. Filers can use their laptops, tablets or smartphones, and receive step-by-step technical support from agents while they prepare their returns.

Arizona is one of a dozen states participating in the pilot program, part of a more significant transformation within the government agency.

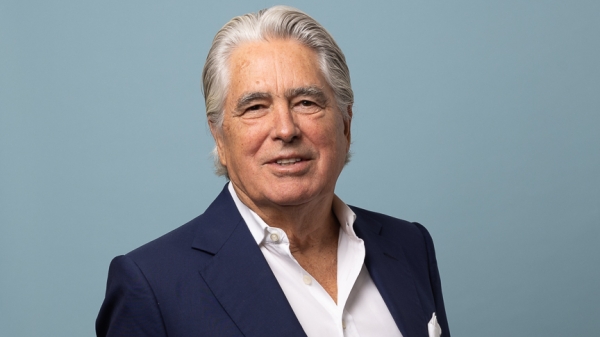

Jenny Brown, an associate professor of accountancy at Arizona State University's W. P. Carey School of Business, is a former accountant for PricewaterhouseCoopers. She teaches courses on individual and business taxation to undergraduate accounting and finance majors, and a specialty course on international taxation to graduate students. Her recent research focuses on how corporate engagement in the political process impacts taxes.

ASU News spoke to Brown to learn more about the new filing system.

Question: What do you think of the IRS’s new Direct File system, and what can filers reasonably expect when they use it?

Answer: I am excited to see the rollout of the IRS Direct File system and optimistic that with a successful pilot this year, the program can extend to cover more taxpayers next year. I hope those eligible for Direct File in Arizona and elsewhere will use it.

Users can access the program from the IRS website: directfile.irs.gov. Before jumping into the program, users must answer several eligibility questions and set up an ID.ME account to verify identity.

The program itself is clean and professional. It’s broken down into five steps: “You and Your Family,” “Income,” “Deductions and Credits,” “Your Taxes 2023” and “Complete.” During these steps, the program prompts users to input information about their tax situation. For example, personal address, occupation, income from employment, interest and Social Security.

Ultimately, users will see a page with their total federal tax return and any amount they owe or refund due. Direct File resembles other commercial online tax prep programs, but it’s bare bones. That’s fine. Many taxpayers have simple returns and don’t need the extra bells and whistles offered by H&R Block or TurboTax.

Crucial for Arizona residents — once users have filed their federal tax return, the program directs them to the FileYourStateTaxes tool to file their Arizona state taxes. This integrated option is a first-of-its-kind project and will allow many Arizonans to file their federal and state returns for free.

Q: Why do you believe Arizona was one of a dozen states picked as a pilot program?

A: Arizona chose to be a part of the program. The Arizona Department of Revenue partnered with the civic tech nonprofit group Code for America to develop the state add-on FileYourStateTaxes tool. Arizona is one of four states participating in this crucial and innovative effort to integrate free federal and state filing.

The other participating states are New York, which also partnered with Code for America, Massachusetts and California. In addition, taxpayers in states without state income taxes (Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming) may be eligible to use the stand-alone Direct File program this year.

Q: What is the IRS’s ultimate goal in deploying this service?

A: Encouraging taxpayers to file electronically and reducing the cost of filing saves the IRS money and allows taxpayers to get their refunds faster. It’s a win-win. Direct File is not the IRS’s first effort at offering free electronic filing. For many years, the IRS has partnered with a consortium of private tax preparation companies offering free online tax filing under the Free File program. That model didn’t work. From 2003 to 2019, an average of 2.8% of eligible taxpayers filed using Free File, with many eligible taxpayers paying for commercial tax preparation instead. Direct File aims to reach more filers, easing the process and reducing the cost of filing for more Americans.

Q: What are some limitations or restrictions under Direct File?

A: This year’s pilot program is limited to filers in one of 12 participating states. Direct File can handle those with relatively simple returns among filers in those states. You may be eligible if you only have income from an employer (W-2), unemployment compensation, Social Security benefits and $1,500 or less in interest income. You’re not eligible if you have other types of income from self-employment, freelance work, investments or rental property. Direct File does not support itemized deductions and only allows for a limited number of credits.

Despite these limitations, the Treasury Department estimates taxpayers could prepare one-third of all filed federal income tax returns using Direct File this filing season. As I say in class, students and recent graduates with W-2 income are prime candidates for Direct File and should not have to pay for tax prep. On the other hand, Direct File will not work well for Arizonans who received the Arizona Families Tax Rebate in 2023.

Q: What result do you hope to see with this new system?

A: I hope many eligible filers in participating states use Direct File this season. Rollout this year is limited by design. The next step is to expand the program to handle more complex tax situations. I’d like to see it support income from gig work (Form 1099-NEC). The IRS already has most of the data it needs from third parties to calculate our taxes. Perhaps in the future, we’ll see an integration of that data directly into the program to make the experience even smoother.

My international tax students think it’s fascinating to learn about countries where the government prepares your return for you. I think there will always be taxpayers with complex financial lives who need the assistance of paid tax preparers. But for Americans with simple situations, wouldn’t it be nice if April 15 meant spending five minutes reviewing an online statement?

Q: What’s the strangest tax loophole you’ve ever seen?

A: Whether one can deduct the cost of a gym membership paid for with the credit card of an LLC as a business expense. Not likely. I commonly get questions like this about “mixed motive” expenses — personal expenses that may also be related to a business. The tax code limits deductions for personal expenses, and there are limitations and restrictions on mixed motive expenses.

One interesting standout I enjoy sharing with students is the parsonage exemption. Ministers who receive a housing allowance as part of their salary can exclude this amount from gross income. Most of the rest of us (non-ministers) must include the fair market value of any housing provided to us in our taxable income. The parsonage exemption isn’t a loophole per se, but for us tax nerds, it’s a fascinating and controversial tax provision.

More Business and entrepreneurship

Thunderbird at ASU alumnus Marshall Parke to deliver keynote at spring 2024 convocation

Marshall Parke, distinguished alumnus of the Thunderbird School of Global Management at Arizona State University and global entrepreneur, will deliver the keynote address at Thunderbird’s convocation…

How sports analytics is changing the game

Have you ever wondered why your favorite basketball team loses season after season? Or why other teams perform well? Height plays a huge role in the NBA — the average NBA player is 6 feet 6 inches…

Blackstone LaunchPad program to support student entrepreneurship skills

The Blackstone Charitable Foundation has awarded a $1 million grant to establish its signature Blackstone LaunchPad program at Arizona State University, and an additional grant to fund paid summer…